utah state food tax

Is a 501c3 public charity and contributions are tax deductible RELATED STORIES Utahs Clark Phillips III vs. 13 hours agoRohner led a referendum effort to stop the 2019 Utah Legislature tax reform package which would have created a 31 increase on the state sales tax on groceries a.

Utah Sales Tax Proposal Should Avoid Layering Taxes On Business Inputs

In the state of Utah the foods are subject to local taxes.

. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state. 15 hours agoThe Salt Lake Tribune Inc. As of this writing groceries are taxed statewide in Utah at a reduced rate of 3.

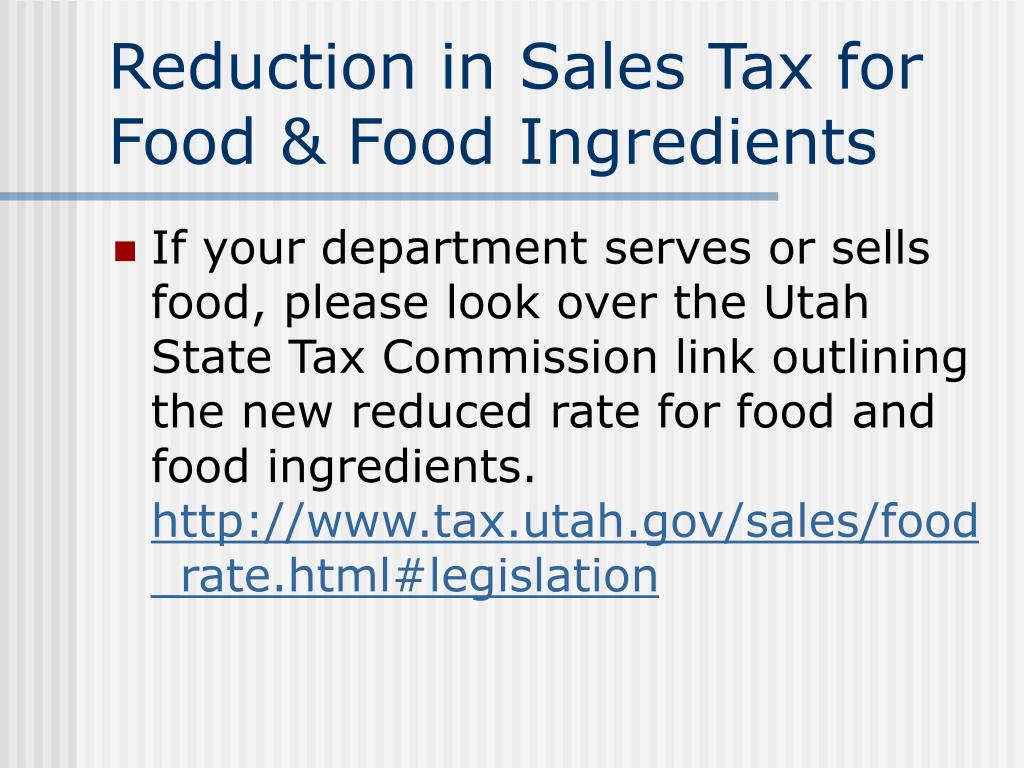

For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other. Both food and food ingredients will be taxed at a reduced rate of 175. Counties and cities can charge an additional local sales tax of up to 24 for a maximum.

The repeal of the states 175 food tax emerged as an issue in the 2022 session pushed by Lesser and the candidates sounded off on the topic. The restaurant tax applies to all food sales both prepared food and grocery food. However in a bundled transaction which.

This page lists the various sales use tax rates effective throughout Utah. Utah just passed a tax reform bill that raised the. Grocery food is food sold for ingestion or chewing by humans and consumed for taste or nutrition.

Rosemary Lesser D-Ogden poses for a photo outside of the Capitol in Salt Lake City on Thursday Jan. Taxing grocery store food unfairly places the burden on the most vulnerable. UTAHS FOOD TAX.

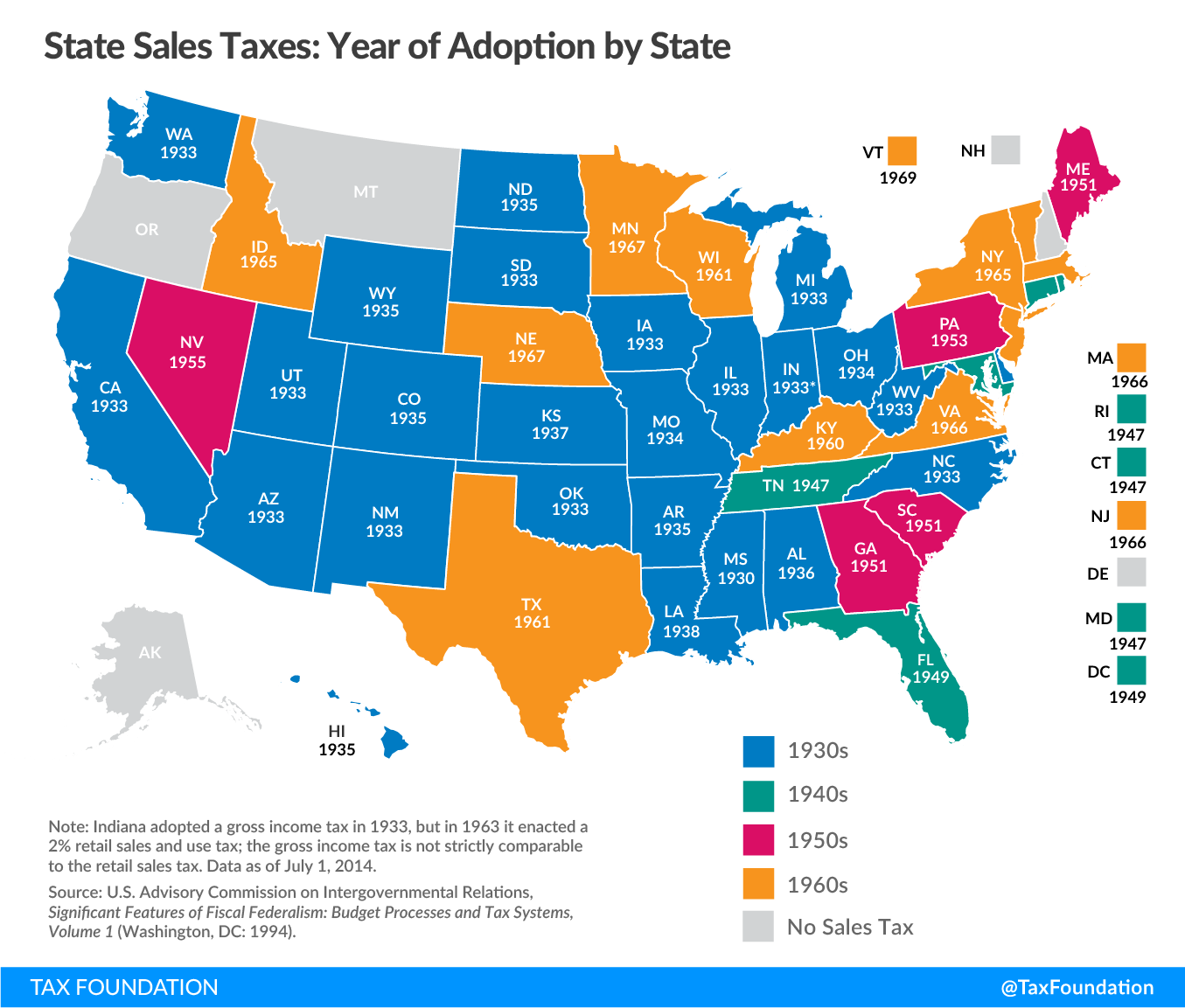

Upping a portion of the food tax is a new proposal lawmakers talked about for hours on Monday as part of the Tax Restructuring and Equalization Task Force. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Tax rates are also available online at Utah Sales Use Tax Rates or you can.

USCs wide receivers will be a. However in a bundled transaction which. Both food and food ingredients will be taxed at a reduced rate of 175.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Lesser is trying to end sales tax on food. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov.

Judy Weeks Rohner R-West Valley City talks about HB165 and HB203 which both aim to eliminate the states sales tax on food during a press conference outside of the. Grocery food does not include alcoholic. The first is sponsored by.

The tax on grocery food is 3 percent. Cities and counties in Utah are allowed to levy their own local sales taxes on grocery food and my bill would not change that. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer.

There are currently two stalled bills in the 2022 General Session of the Utah Legislature with the aim of ending the 175 state sales tax on food. In the state of Utah the foods are subject to local taxes. Its a regressive tax that unfairly impacts the economically poor.

File electronically using Taxpayer Access Point at. The state currently earns close to 149 million.

As Food Prices Soar Some States Consider Cutting Taxes On Groceries

Jello Became Utah Official State Food

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

Quarterly Sales Tax Rate Changes

Sales Tax By State To Go Restaurant Orders Taxjar

5 Outrageous Foods To Try At The Utah State Fair

Opponents Of Proposed Food Sales Tax Increase Say Low Income Families Will Suffer

Digesting The Complicated Topic Of Food Tax Article

Sales Tax Laws By State Ultimate Guide For Business Owners

Call To Action To End Utah S Food Sales Tax

Sales Tax On Grocery Items Taxjar

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

More Utah Grocery Stores Are Helping With Signature Gathering For The Tax Referendum

How Do State And Local Sales Taxes Work Tax Policy Center

Eliminating Grocery Sales Tax In Utah Likely Wouldn T Help Low Income Families Expert Says Ksl Com

Ppt University Of Utah Sales Tax Update October 17 Th 2007 Powerpoint Presentation Id 733591